Closing the accounts – drafting financial statements, or “The last thing to do when we close the accounts for the year”

Drafting financial statements

At this stage, we have an adjusted trial balance, with adjusted debit and credit balances. These balances are ready to be used in drafting the financial statements.

Financial statements comprise 4 items:

1. Income Statement (sometimes called the Profit and Loss Account)

2. Statement of Owner’s Equity

3. Balance Sheet (sometimes called the Statement of Financial Position)

4. Cash Flow Statement

They are usually prepared in the above numbered order, for reasons that will be clear later.

Want to refresh your memory about what happens before we reach this stage? Go to Adjusting Entries.

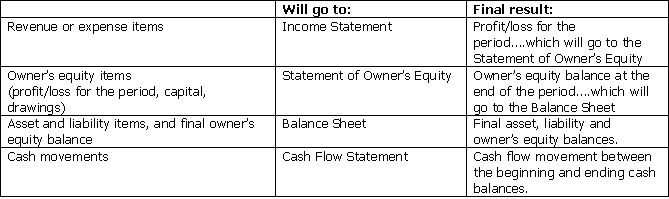

The items in the adjusted trial balance are classified as follows:

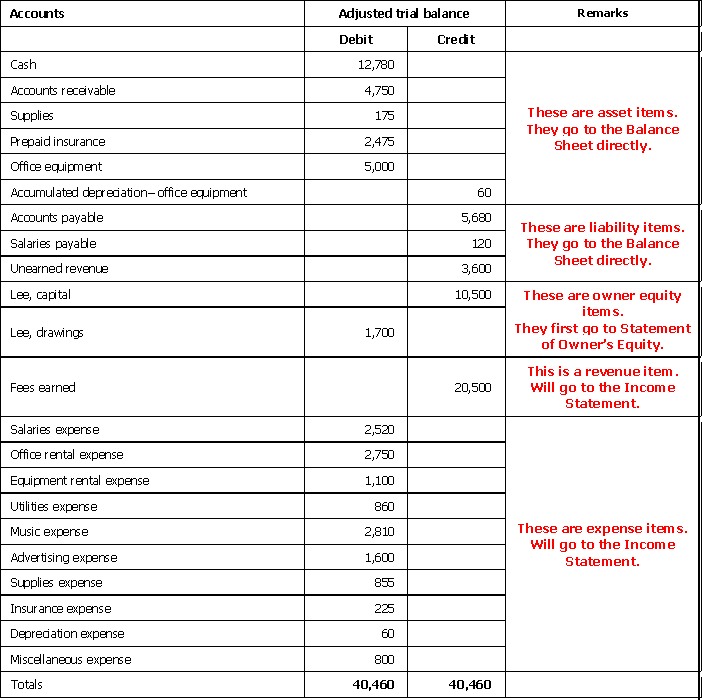

Let us look at an working example. The following is an adjusted trial balance, with added remarks:

Let’s assume that the capital of $10,500 was invested into the business during the period.

The accounting period in question is the period ended 31 July 2010.

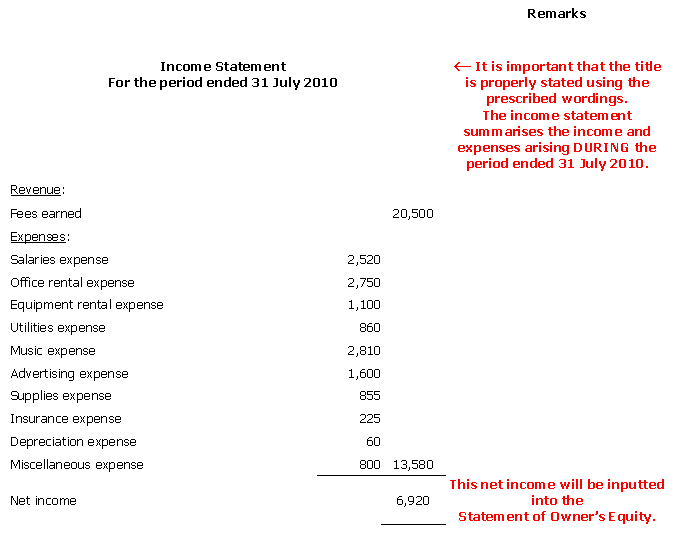

First, we draft the Income Statement, together with remarks (remember, these remarks are only for teaching purposes, they do not form part of the income statement itself!):

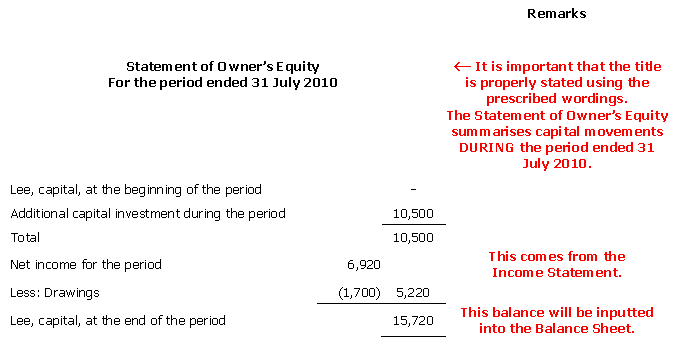

Next, we draft the Statement of Owner’s Equity:

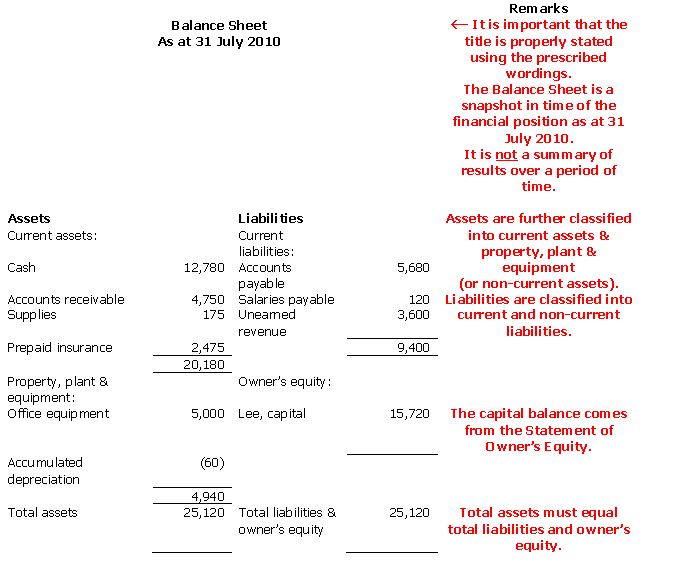

Then, we draft the Balance Sheet. A balance sheet is classified into different sub-sections, as follows: current assets, property, plant and equipment, current liabilities, long-term liabilities and owner's equity.

Notice that the balance sheet is divided into 2 columns, the left side is represented by assets and the right side is represented by liabilities & owner's equity - just the same as it is in the accounting equation. Want to read about the Accounting Equation? Go here.

However, there are many ways of drafting a balance sheet - this is just one of the many formats used.

At this stage, we have now drafted financial statements - 3 of them, that is!

We will discuss the Cash Flow Statement in another section.

Return to Accounting Adventurista Home from Drafting Financial Statements